Banking and finance: 3 keys for digital success in 2020

Banking and finance: from product to customer

The communication processes of a bank and even financial intermediaries used to be designed and built around offering a service. Then there was a change: the end user became the protagonist of the social revolution ushered in Industry 4.0.

Banks and financial institutions then shifted from the product to customer needs.

Plus, in 2020, all companies had to deal with unexpected dynamics that have accelerated a process that wasn’t up to speed: the corporate digital transformation, including banks. This year, those unfamiliar with digital banking concepts and online transactions embraced the technology and found out it’s not that bad.

Experts say that such a new, large audience will keep connecting with companies this way in the future. For banks, this is a new pool of customers to satisfy and retain.

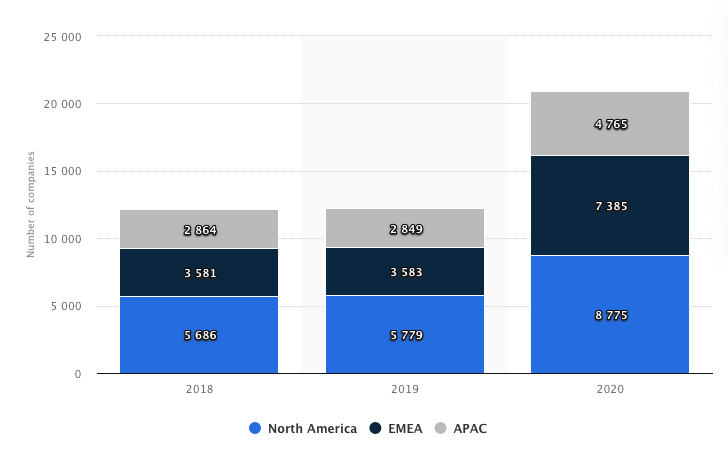

Fintech: a digital force affirmed in 2020

The sector’s growth rate is exponential: fintech is a digital force that’s changing the entire sector. The data is clear: investments have grown around the world, going from 1.89 billion dollars in 2010 to 53.3 in 2019.

Source: Statista

The sector is ready, and so is the public. Competition is already fierce, and the challenges for banks and financial institutions to overcome — like security, accessibility, as well as the internal mindset — are many.

Why is email the pillar of web marketing strategies?

According to the 2018 Email Marketing Industry Report, email is the most effective digital channel for 68% of marketers, and 59% said they generate the most ROI through it.

Speaking of ROI, for every dollar spent on Email Marketing, the average expected return on investment is $42. With such a high ROI, there’s no surprise that the email channel is one of marketers’ preferred content delivery methods.

Another interesting fact comes from the Content Marketing Institute: 2019 statistics show that 87% of marketers use Email Marketing to distribute their content.

Email Marketing for banking and finance

Email is a key element in the bank-customer relationship because it lets you develop commercial, informative, and relational objectives through DEM campaigns, newsletters, transactional messages, etc.

But more than anything, email is the perfect channel to go beyond the generic offer, the so-called one-size-fits-all solution. The 2020 success of banks’ digital strategies will depend on their ability to create a one-to-one relationship with customers through proposals specific to the individual.

Today, digital customers want to be able to do anything, anywhere without friction.

There are two aspects of email marketing where the banking and financial sector must focus on due to recent technological and digital changes:

- on the one hand, security, i.e. the sending infrastructure,

- and on the other, Marketing Automation, which allows for crossing channels and personalizing email campaigns.

Now let’s dive into the fundamental technologies and tools that enable banks, institutions, financial institutions, and investment companies to exploit the potential of Email and SMS Marketing to safeguard the secure mailings and cultivate a one-to-one relationship with the customer.

1. Infrastructure: ensure email security and delivery

Key when it comes to Email Marketing in the banking and finance sector is the security of sending communications in an increasingly digitized world. That’s why it’s important to focus on the sending infrastructure.

There are two main benefits of a strategy focused on improving the infrastructure:

- high delivery rates for email campaigns

- user protection from spam and phishing.

To improve the infrastructure, it’s necessary to analyze the factors that influence deliverability. You must also use the numerous available methods to ensure recipient safety, i.e. email authentication systems. SPF, DKIM, DMARC, and BIMI are the main ones.

2. Customer experience: cultivating the customer relationship

According to the 2020 Banking and Capital Markets Outlook from Deloitte US, disruptive forces are changing banking activity. Over the next decade, a new wave of disturbances will become stronger and more pervasive than we’ve seen in recent years.

The first driver of change will be technology. Banks will need to strengthen their foundations across multiple dimensions like tech infrastructure, data management, risk, and talent.

Customer experience is what will allow the sector to take full advantage of the new opportunities. The challenge for online banks will be to focus on brand equity and add value for the customer.

Today’s consumers want targeted, personalized content—they don’t want to feel like you’re constantly trying to sell them something. Brands must focus on personalizing the customer’s journey by investing in the content quality of their online experience.

3. Marketing Automation: piecing together the customer journey

Automation lets you reach the customer with the right communication at every level of the customer lifecycle. It automatically enhances each point of contact and each phase of the customer relationship.

Email and SMS web marketing strategies should harness personalization and automation to:

- build a solid relationship with the customer

- convert faster

- build and retain loyalty.

Banks and online strategies: from theory to practice

Banking and finance have made it to an advanced stage in planning digital strategies. But to effectively implement new practices, they need continuous updating and in-depth knowledge of online tools.

MailUp can help you get important tips to transform ambitions into actual Digital Marketing practices. Request a consultation and let the MailUp team of experts use Email and SMS Marketing to advance your online strategies.